How To Find Operating Income In Accounting

What is Operating Income?

Operating income, besides referred to as operating profit orEarnings Earlier Interest & Taxes (EBIT) , is the amount of revenue left after deducting the operational direct and indirect costs from sales revenue. It can too be computed using gross income less depreciation, amortization, and operating expenses not directly attributable to the production of goods. Interest expense, interest income, and other non-operational revenue sources are not considered in computing for operating income.

Below is an instance of income from operations highlighted on Amazon.com Inc.'s 2016 income statement.

Formula for Operating income

There are three formulas to summate income from operations:

1. Operating income = Total Revenue – Direct Costs – Indirect Costs

OR

ii. Operating income = Gross Profit – Operating Expenses – Depreciation – Acquittal

OR

iii. Operating income = Net Earnings + Interest Expense + Taxes

Sample Calculation

D Trump footwear visitor earned total sales revenues of $25M for the 2d quarter of the electric current year. For that menstruum, the cost of raw materials and supplies used for the sold products was $9M, labor costs directly applied were $2M, administrative and staff salaries totaled $4M, and in that location were depreciation and amortizations of $1M. As a result, the income earlier taxes derived from operations gave a total amount of $9M in profits.

What are Revenue and Gross Turn a profit?

Sales revenue or net sales is the monetary amount obtained from selling goods and services to business customers, excluding merchandise returned and any allowances/discounts offered to customers. This tin exist realized either every bit cash sales or credit sales.

On the other manus, gross profit is the budgetary result obtained after deducting the cost of appurtenances sold and sales returns/allowances from total sales revenue.

What are Straight Costs?

Directly costs are expenses incurred and attributed to creating or purchasing a product or in offer services. Often regarded equally the toll of goods sold or cost of sales, the expenses are specifically related to the cost of producing goods or services. The costs tin can be fixed or variable but are dependent on the quantity existence produced and sold.

Examples of directs costs are:

- Direct materials and supplies – Parts, raw materials, manufacturing supplies

- Direct labor – Services employed to directly industry a production, such as machine operators, mill workers, associates line operators, painters

- Ability and water consumption – Electrical bills and water usage attributed to the production

- Toll of merchandise – The price of the finished product for resale plus shipment costs

- Commissions or professional person fees – The cost of delivering services, specifically in service-oriented businesses such as insurance, real estate, consultancy, and law firms

What are Indirect Costs?

Indirect costs are operating expenses that are not directly associated with the manufacturing or purchasing of goods for resale. These costs are frequently accumulated into a fixed or overhead toll and allocated to various operational activities.

Examples of indirect costs are:

- Salaries and related benefits of production managers and quality assurance staff

- Maintenance cost and depreciation expense of factory equipment

- Rent of manufactory facility

- Utilities non directly involved in creating or purchasing goods

Examples of selling and administrative indirect costs are:

- Salaries and benefits of corporate managers and staff

- Role supplies

- Depreciation of office building, equipment, piece of furniture, and fixtures

- Role facility hire

- Maintenance and repairs

- Utilities such equally electricity, water, telephone lines

- Insurance and amortizations

- Marketing and ad costs

- Travel expenses

Operating Income = EBIT

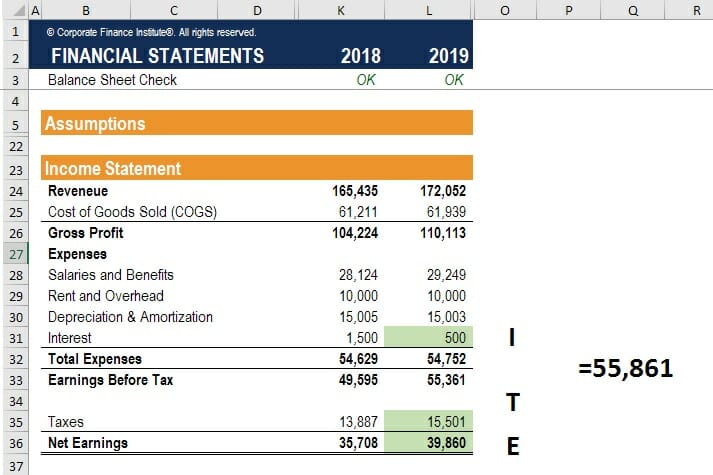

Another manner to summate income from operations is to commencement at the lesser of the income argument at Cyberspace Earnings and so add back involvement expense and taxes. This is a mutual method used by analysts to calculate EBIT , which can and then exist used for valuation in the EV/EBIT ratio .

Below is an instance calculation of EBIT:

- $39,860 Earnings

- +$xv,501 Taxes

- +$500 Involvement

- =$55,861 EBIT

Learn more than about EBIT and EBITDA here .

Download the Free Template

Enter your name and email in the form below and download the costless template now!

Operating Income Template

Download the free Excel template now to advance your finance knowledge!

What is the Importance of Operating Income in Business concern?

Operating income is considered a critical indicator of how efficiently a business organization is operating. It is an indirect measure of productivity and a visitor's power to generate more earnings, which can and so exist used to further expand the business organization. Investors closely monitor operating profit in order to assess the trend of a company's efficiency over a period of time.

Operating profit, like gross profit and net profit, is a fundamental fiscal metric used to determine the company's worth for a potential buyout. The higher the operating profit as time goes by, the more finer a visitor'southward core business is being carried out.

More Resources

Thank you for reading CFI's guide to Operating Income. If you're interested in advancing your career in corporate finance, these CFI articles will assistance you on your way:

- Operating Margin

- Contribution Margin

- EBITDA Margin

- Existent Estate Investment Trust (REIT)

Source: https://corporatefinanceinstitute.com/resources/knowledge/accounting/operating-income/

Posted by: joinernessiogs.blogspot.com

0 Response to "How To Find Operating Income In Accounting"

Post a Comment